5 Steps to Save Your Retirement

© Donnie McKinney 2011

Note: This is a website I created to share with friends & family. You're welcome to use it. However, if someone shared this link, and you've never heard of me, you may want to go to www.donniemckinney.com before you read any further, and decide whether you want to listen to anything I have to say.

I’m NOT a financial advisor. I’m just a 64 year-old guy who can’t afford to lose my retirement money. In fact, most of the “smart” actions I’ve taken in the past in my own retirement fund have been, for the most part, by accident. So, I’m not going to give you financial advice in this report. I am going to tell you what I’m doing, why I’m doing it, and who I learned from so you can become educated and make your own decisions while there is still time.

I must warn you that many of my friends & family think I'm nuts ;) I prefer to think that the "normalcy bias" simply prevents many people from believing the information I'm about to share is remotely possible. You can decide for yourself.

My Brilliant Financial Moves

I missed the gold/silver bubble in 1980. My wife, Marsh, and I were on a plane headed to Hawaii when I read in a newspaper about the Hunt brothers buying up all the silver in the world. I had thrown a lot of silver quarters in a bag when the US Treasury first devalued our coins by changing to copper/silver sandwiches. My $10 rolls of quarters were worth $200/roll! But, by the time we got home, the bubble had burst.

I didn’t make any money, but I did make a mental note.

My best accidental financial genius mistake occurred several years later when the dot com bubble burst. By that time we actually had a sizeable nest egg in our 401-K plan, in which I could choose my own mutual funds. Almost everybody in our fund lost close to 60% of their retirement funds almost overnight. I didn’t.

Why? Sheer stupidity.

My company had changed plan administrators a few months earlier and I was supposed to log in and move the funds wherever I wanted them to be invested. I forgot to do it. Dumb, but the money market funds were, accidentally, the best 4.18% I ever made.

I also made another mental note.

I was able to take advantage of my genius stupidity and move all my accidentally salvaged retirement funds into an aggressive mutual fund about the third week in October, 2001, right after 9/11. My funds doubled in little over a year. I love being financially stupid.

While remaining blissfully oblivious to economic cycles, instead of losing most of my retirement funds, I had made significant gains. I was fortunate.

Why tell you about my stupidity?

I said all that to illustrate this. Most of us either make money or lose money in our retirement funds without ever having an understanding of the fundamental forces involved. In some areas ignorance is bliss, but not in the near future where our IRAs and 401-Ks are concerned.

If we don’t have a basic understanding of wealth cycles, and what’s going to happen next, we will inevitably end up where the vast majority of people end up when a major transfer of wealth takes place – losing our hard-earned retirement funds.

Here’s what woke me up. I told you what I’m NOT. I’m NOT a financial advisor. Don’t take anything I say as financial advice. I AM an expert in Commercial-Investment real estate.

Last summer, I was brainstorming ways to improve my sales in a really slow market. I saw a lot of good deals out there, but cash was king. The problem is no one had any cash, and banks wouldn’t loan anybody any cash.

It dawned on me that people could invest their retirement funds in stable, cash-flow income-producing commercial properties. I finally found all the right pieces to the puzzle allowing people to set up Self-Directed IRAs. The next step was to start a educating people about commercial real estate investing. But, that’s not the purpose of this report.

Just as I was about to launch my new program, I began studying the economy. That’s when I learned about wealth cycles. Boy, were my eyes opened! Now, I have a whole new mission in life.

Doing “great” until I’m flat broke

First, though, one more illustration of how I, and I suspect many of you, have been “educated” about investing our IRA funds. A few years ago, after I had doubled my own IRA fund through sheer luck, totally by accident, I decided to put it in the hands of a professional.

When the stock market started feeling shaky to me, I suggested that maybe money market funds would be a good idea for a while. I got the standard lecture about how my IRA funds had been “diversified” into various assets that not only wouldn’t go down much when the stock market took a dip, but would also come back up very quickly.

Unfortunately, I decided to leave the money in my "diversified" portfolio.

“Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.”

Warren Buffet

Like most of you, I suspect, I bought into the investment diversification theory. You know what happened right after that, in 2007-2009. Another crash! This time the debt bubble burst.

Guess what my professional advisor told me when I called, “Hey, you did great. The market went down over 40% and your funds only went down around 30%!”

It didn’t take me long to realize that I was going to be doing “great” until I was flat broke!

Going down less than the market?

Not my idea of building wealth

OK, here’s where you can get your money’s worth from this free report. I don’t plan to watch my retirement funds go through any more crashes. I’m too old to make the money back.

I’ve listened to Dave Ramsey tell us to “invest in good mutual funds and they will average 12% growth” over and over on his radio show. I’ve met Dave. I like him. It’s just that he’s had the same philosophy drilled into his brain as we all have.

I've begun to understand that the days of investing in stocks for the long haul are over!

As I said at the beginning of this report, I’m not going to give you financial advice. I’m going to give you education advice. I have learned so much recently that my head is about to explode. Nothing else in my 64 years of living and learning has ever motivated me to set up websites and write reports to warn people about a pending disaster like this knowledge has. I hope you profit from it as I plan to.

Do you know when more millionaires were created in the United States than any other time in history? During the Great Depression!

That’s hard to comprehend until you understand wealth cycles and how wealth transfers from one asset class to another. During the Great Depression, almost everybody lost everything they had. Yet, more millionaires were created than at any other time in US history. Why?

Because they were in the right assets. Are you?

The coming stock market crash

I’m firmly convinced that stocks are NOT the right asset class right now. We are about to see the biggest stock market crash in our history. This crash will be bigger than Black Friday in ’29. It will be bigger than Black Friday in ’87. It will make the dot com bubble burst look like good times.

I know that’s hard to even comprehend right now, while the market is looking so bullish, but it won’t sound so radical once you learn about historical cycles and about the unprecedented forces all coming to a head RIGHT NOW in the global economy.

There are two totally separate sets of forces in play, and either may cause the greatest stock market crash in history. You can choose which one you want to prepare for, but the result will be the same - further devestation of our retirements!

The first set of forces point to about four years from now. I’m going to cause it. Read Robert Kiyosaki’s book, Prophecy.

Well, I’m not going to do it all by myself, obviously. But, I am the first of the baby-boomers. We baby-boomers are going to wipe you out if you're not prepared. We are the pig moving through the belly of the snake. We have caused booms and busts throughout our lives. We first, and then our offspring, caused housing booms. We’re a force to be reckoned with.

We’re the ones who have fed the stock market for the past twenty or thirty years with our IRA & 401-K contributions. We ARE the bull market. Therein lies the problem. What will happen when we start making monthly withdrawals from our IRAs?

We’ll be SELLING STOCKS every month!

Instead of being an unprecedented group of stock buyers, which we have been for several decades, we will become an unprecedented group of stock sellers. And, we'll be stock sellers in a big way. The pig moving through the belly of the snake. Who is going to buy all that stock we are unloading?

What will happen to stock prices when there are way too many sellers, and not enough buyers?

We are going to kill our own retirement funds

There is no way to avoid the coming crash that Kiyosaki wrote about. When I asked my financial advisor about the effect of all of us baby-boomers selling stocks at the same time, right before I closed out my account and opened a self-directed IRA, he said, “There aren’t very many people withdrawing funds, yet, and there will be others buying when that happens.”

Hmm. That didn’t reassure me much.

There is no other pig coming behind us in the belly of the snake.

Kiyosaki wrote his book, Prophecy, eight years ago, warning us about a phenomenon that will occur around 2016 when we baby-boomers are forced to start making monthly withdrawals. Some of us have already started. We know it’s going to happen, but we may have some time to prepare for it. It will require some serious thought and planning.

But, that’s not what turned me into a missionary and forced me to write this report.

So, what’s all the urgency?

It’s the second set of forces that caused me to get out of all stock or bond related investments in my own IRA. The fact is, there may not be a stock market left to crash in four years when Kiyosaki's prediction of a stock market crash comes to pass.

The phenomenon Mike Maloney calls “wealth cycles” is what opened my eyes to new insights that I had been blind to in the past. Maloney uses historical graphs to show what has happened over and over in our economy as different classes of assets move through bull and bear markets.

All the bubbles burst. Gold and silver bubbles burst. Stock market bubbles burst. Real estate bubbles burst. We know debt bubbles burst.

There are so many different forces in play at the same time, RIGHT NOW, it is almost inevitable that we will see a huge stock market crash in the near future. You’ve probably already read about some of those forces in the news. I’m not the expert, so I’m not going to get into a long explanation of these factors. I will give you a link to Michael Maloney’s website below, and you can learn from someone who IS an expert.

Of course, the biggest culprits in this entire economic debacle are the people you and I have elected to run our country. We think we have a free market economy, but our elected officials keep meddling with it. The huge debt bubble that burst and caused the last big crisis was a direct result of government meddling. Fortunately, that one only cost us 40% of our retirement savings.

It will be much worse this time around.

What our elected officials are doing right now is even more serious, and will bring even more dire consequences. What little housing sales we do have, and the recent “bullish” stock market are a direct result of the feds manipulating interest rates and creating currency like it’s going out of style.

Um, that’s a whole ‘nuther discussion. The dollar IS going out of style.

Here’s the big picture

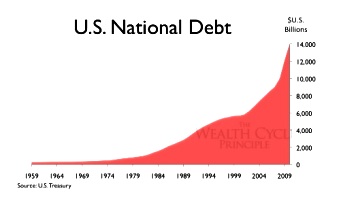

Without trying to become an economist, I do want to show you a couple of graphs I copied from wealthcycles.com, Michael Maloney’s website. These are just two of dozens of graphs Maloney uses to illustrate what has happened historically, and what is about to happen in our economy. First, take a look at the national debt.

It doesn’t take long to see that we have an unsustainable debt load, and most of it is very recent. If you add in all our other debt obligations, including social security, medicare, government pensions, etc., the tab comes up to about $1,000,000 for each of us.

I can't write my check. Can you?

The only way our nation could possibly pay off that kind of debt is with an ever-expanding economy, but the pig is already through the productive years of the snake.

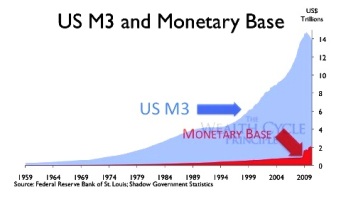

Now, take a look at the supply of currency.

Over the past 85 years or so, the supply of currency barely increased. But, look what has happened in just the past few years! It takes a lot of newly-created currency to bail out failing companies, create stimulus packages, maintain artificially low interest rates, attempt to spur the economy and keep the stock market looking bullish.

What’s going to happen next year?

Do you think our guys in Washington will choose to fix the economy, causing a lot of misery in the process, or try to get re-elected? And, the longer Washington meddles in the free market, the worse the crash will be. Actually, President Obama just told us what they are going to do when he released his budget.

"Mr. Obama's budget projects that 2011 will see the biggest one-year debt jump in history, or nearly $2 trillion, to reach $15.476 trillion by Sept. 30, the end of the fiscal year. That would be 102.6 percent of GDP - the first time since World War II that dubious figure has been reached."

The Washington Times, Feb. 14, 2010

When is the crash going to happen?

Doom & gloom? Sorry, I didn’t mean to ruin your day. But, I do want to wake you up, as I’ve been waked up, so you will have a chance to take steps to keep from losing almost all of your retirement in the next crash.

I’m going to give you some specific steps, below, that I believe will not only save your retirement from certain ruin, but hopefully, dramatically increase it.

But, first, how can we know when this huge crash will occur?

I learned something from Earl Nightingale, when I was about 19, that has helped me through all sorts of situations, and it has never let me down.

“If you can figure out what the vast majority of people are doing in any given situation and do just the opposite, you will never make a mistake, because the vast majority of people are always wrong.”

Earl Nightingale

If there ever was a time to do the opposite of the vast majority of people, it is RIGHT NOW!

I was on a ski trip with our youth group in January. As we were leaving the motel to board the bus to come back to Kentucky, I picked up a USA Today newspaper from the counter. I almost spilled my coffee on the bus when I opened the Money page and saw the headline –

“Stock recovery’s firmly on track”

(USA Today, January 17, 2011)

What?!? I had just sold every stock and mutual fund in my IRA. I even paid a $9,000 penalty to cash in an annuity with Prudential, because I know what’s coming.

USA Today's headline is a perfect example of the classic signs of the euphoria prevalent before a huge crash. Think back to the dot com bubble. When EVERYBODY is jumping in, and all you hear on the news is how great the stock market is doing, follow Nightingale’s advice - do just the opposite.

Oops, sorry. That sounded like financial advice, which I’m not giving.

Think back to every crash, or bubble bursting, in our lifetime.

When EVERYBODY jumped on the gold/silver bubble in 1980, the bubble burst and the vast majority of people lost their money. The Great Depression? The dot com crash? The debt bubble?

The vast majority of people are always the big losers.

Obviously, I don’t know exactly when this crash is going to occur. I’ve read a lot of different opinions, from a lot of different “experts.” Nobody knows. But, they all “know” it’s coming.

Here's a good indication. I was in a customer's motel waiting in the lobby for our meeting a month later, when I saw another USA Today article. This one was too hot to put in the Money section. It was on the FRONT PAGE. The writer was describing how lots of individuals were moving back into the stock market. To him this indicated a trend and a restoration of confidence in the market (USA Today, February 11, 2011).

A trend? Or, the signs of the euphoria that comes right before a market crash, when the "vast majority of people" jump in and buy stocks? You decide.

My own “gut” feeling, after digesting everything I’ve learned, is that it might just be very soon.

That’s why I cashed in every stock-related investment in my IRA, and opened a Self-Directed IRA so I could invest everything in real estate and silver to protect my assets. That may sound pretty radical to you, right now. It sounded radical to me a month ago.

However, for the first time in many years, I feel very secure in my retirement.

What’s the solution?

You’ll have to learn about wealth cycles from Mike Maloney to begin to understand why I acted so radically. In a nutshell, EVERY time in history that people have felt uneasy about the economy, the stock market or the currency, they have gone to precious metals.

RIGHT NOW, the economy, the stock market and the currency are ALL THREE in peril.

There has never been a time in American history that all three factors have been in play at the same time, like RIGHT NOW.

In fact, every currency in the global economy is in the same condition as the dollar, RIGHT NOW.

Every major stock market in the global economy is in lock-step formation with Wall Street, RIGHT NOW.

Listen to what Maloney says in his essay, The Road Ahead:

“In all possible scenarios, there are only two certainties: The government will continue to print more and more currency; and the currency will continue to lose value. The stage is set for the largest transfer of wealth in history. For 5,000 years, as economies have fallen and fiat currencies collapsed, people have turned time and again to the haven of gold and silver.”

Michael Maloney

You’ll have to decide where your retirement funds should be invested. No one can do that for you. I’m just explaining why I did what I did with mine. I plan to take part of what Maloney says will be “the greatest transfer of wealth in the history of mankind.”

Every bubble bursts. After precious metals, what asset class will wealth transfer into next? Maloney says we are about half-way into the bull market in precious metals. That bubble, too, will burst. They all do. By the time the gold bubble bursts, real estate will likely be at it's low point and at the beginning of a very long bull market.

That’s why I'm teaching people how to invest in real estate.

After the stock market has crashed, and I have profited from the bull market in precious metals, real estate will be devalued even more than it is now, and I can truly invest for the long haul in income-producing real estate. There are some good values our there, right now, actually.

I want to teach you everything I know about Commercial-Investment real estate, so you'll be ready to profit from “the greatest transfer of wealth in the history of mankind.”

We will have to teach our kids how to be prepared for the next bubble.

O.K., let’s get to specifics

Here are the vital steps to salvage your IRA or 401-K before it’s too late:

1. Do some research.

Don't take my word for anything, but get educated. Here are some places to start:

A. Watch this Tony Robbins' video.

Tony has some of the wealthiest people in the country as clients in his motivational business. He recently did a 23-minute video, not trying to sell anything, but simply to ease his conscience and warn people about what he has learned about the coming stock market crash from his wealthy clients.

The video is in two parts on You Tube – Part 1 -Tony Robbins Video, (Click on Part 2 beside the video)

Tony’s video is just another way of looking at the situation. I’ll share lots of others through my Facebook Fan page (see below).

B. Read some books.

I went to Amazon.com and ordered all of Robert Kiyosaki’s books, plus Mike Maloney’s book, How to Invest in Gold & Silver (it’s mostly about wealth cycles).

Once you’ve begun to understand wealth cycles, you may decide to get all your money out of the stock market right now, and put it where it will grow instead of devalue. If you’re a slow reader, get your money out now, and read later! Oops, no financial advice.

C. Check out Mike Maloney’s website.

He has a wealth of information that explains what has happened historically and what is going to happen in the near future. Lots of great videos.

I bought a premium membership. You can decide whether you want to. It’s pretty cheap, and he’s the guru on wealth cycles. It’s the most fascinating information you'll ever learn. You can also simply go to youtube.com and watch a few of over seventy of his videos there.

D. Check out Robert Kiyosaki’s website.

Kiyosaki is a financial genius. I read his book, Rich Dad, Poor Dad, when it came out a long time ago. He explains the economy and how to increase your wealth in simple terms.

E. Check out The Elevation Group.

It’s more expensive than Mike Maloney's site, but I suggest trying it for a month or two whether you join annually or not.

This is the place I started getting my mind exploded with new knowledge. Mike Dillard is interviewing some of the wealthiest and smartest people around, and sharing videos of his interviews with us members.

That’s where I found out about Mike Maloney and wealth cycles. It’s the best investment I ever made. Check it out at - The Elevation Group

2. Take control of your IRA or 401-K.

Change it over to a Self-Directed IRA. This is the only way to take control of your retirement.

You can do this with several administrators. I like and recommend The Kingdom Trust Company. I've personally met all the people there, and they are not only highly-qualified, but also good, honest Christian folks.

I set up a Self-Directed IRA with them, and I’m recommending them to everybody in my program. It will be vital to be prepared, whether you decide to think about investing their IRA funds in real estate at some point, or not.

Changing it to a Self-Directed IRA doesn’t affect any of your investments if you don’t want to change them right now, but it gives you the freedom to do the things you probably cannot do with your current IRA - whenever you want to. I suggest everybody take this one step, if nothing else, RIGHT NOW. Take control before it's too late!

3. Decide where to "park" your funds.

Here's what I did. No financial advice. I’m not a financial advisor. I'm just telling you what I did. This probably sounds radical to you right now, but it won’t after you spend some time getting educated. After learning about wealth cycles, I took all my cash from getting out of stocks & mutual funds and am investing it in real estate and silver. You may decide on a different investment strategy. Decide what is right for you.

Key Points: Cash is going backwards in value, and its deflation will escalate in the near future. Gold & silver are in the middle of a huge bull market, but it's vital to know when that bubble is about to burst. Real estate has undergone significant deflation, and good, cash-flow income-producing real estate will produce cash flow even if it deflates a bit more.

The Elevation Group will also teach you how and where to buy gold or silver, if you decide you want to. It’s not complicated. Again, you can check them out at The Elevation Group. Watch the free video in which Mike Dillard summarizes everything I've been saying in much clearer terms.

4. Take advantage of my FREE COURSE in investment real estate.

Start learning about investment real estate. There’s no cost. I’m just going to teach everybody who joins everything I have learned in 20 years of experience in Commercial-Investment properties.

If you join now, you will learn everything you need to know to understand, analyze and eventually invest in real estate. And, . . . you will also be ready to take advantage of the coming huge bull market in real estate if you decide to do so. .

Click here to sign up for the Commercial Real Estate Academy. (If you don't have Face Book page, just email me)

There are no "gotchas," just valuable information that will make you a lot of money in the future.

5. Check out our IRAs in Real Estate Program.

Our Commercial Real Estate Department will teach you everything you need to know to invest IRA/401-K funds in real estate. No obligations, no "gotchas," just great info.

Oh, btw, our program isn't restricted to IRA investments. You can now take advantage of our program to invest in real estate with any amount of money. Through Commercial Real Estate Academy, you will learn everything you need to know to feel confident in investing in high-yield, safe, income-producing properties.

I feel better, knowing you know

OK, now I feel better. What you do with the information I’ve shared is up to you.

I can understand Tony Robbins’ feelings when he said he just “had” to make his video. I’ve learned so many new things recently that my brain hurts.

But, if I just went merrily on my way, without sharing what I’ve learned with you, I would feel really guilty knowing that just a little knowledge could have saved your retirement and mine, and maybe everything else we’ve worked so hard to have.

Take the steps above. Save my conscience.

If you have any questions, feel free to call me - 270-450-2222

or Email Donnie